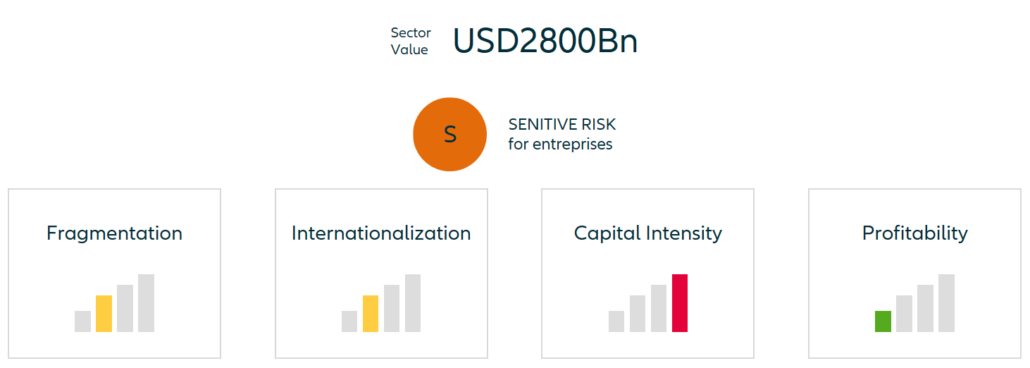

Metal sector: Cyclical momentum vs Structural challenges

Contribution by Euler Hermes.

What to Watch?

- Global trade momentum and political intervention

- Indications of demand strength, particularly in China, but also in construction and automotive

- Management of overcapacities

As a whole, after a weak 2018, the outlook for the metals sectors is mixed. Economic trade uncertainty has compounded the problem of slowing metal-consuming industries. Metals is one of the most exposed sectors as far as the impact of protectionism is concerned.

Steel demand growth will weaken considerably as a result of a slowing economy and uncertainties over trade. While there is still growth in the automotive sector, its reduced rate will weigh negatively. At the same time, the outlook for construction, one of the most important end markets, remains mixed despite moderate growth in a number of large markets. Strength from the machinery sector is unlikely to outweigh that.

The World Steel Association forecasts 1.4% y/y growth for 2019, compared to 3.9% demand growth for 2018. Chinese demand is expected to be flat.

Steel prices continue to reflect overcapacity, while iron ore prices pressure margins. Earnings are still being revised downwards. The current consensus stands at a 14% y/y earnings decline.

Aluminium also presents a patchy picture. There is a risk that the Chinese aluminium market might flip into excess capacity as capacity gets commissioned in despite curbs and Russian producers see sanctions eased. The sector should see demand growth in the order of 3%, according to guidance by some of the major producers for 2019, with aerospace a positive driver. There is potential for a global production deficit, also due to production outages. Yet, margins are tight because of raw material prices, and the scope for aluminium price recovery appears limited.

Copper will to a great degree depend on the success of Chinese stimulus measures. An increase in supply may curb price increases, though, and balance the market. Further USD appreciation will have a negative impact on all metal prices. Margins are likely to compress in the mining sector, due to weak prices, to the tune of 300bps at Ebitda level on 12% y/y revenue decline in 2019 according to current consensus (source for all consensus data: Bloomberg). Nevertheless, the sector is cash generative, and with net debt standing below 1.0 on average for the global peers, they should be able to deploy such cash into incremental capex, in the order of 5-8%, chiefly going into equipment replacement.

Iron ore: A correction is likely after prices have come off a peak in early 2019 and the demand outlook is patchy.

Steel companies: Global overcapacity but the high level of import taxes protects some specific markets such as US and Canada.

Nonferrous: The sector is cash rich on the back of strong prices. The LME Index has risen 17% in 2018.

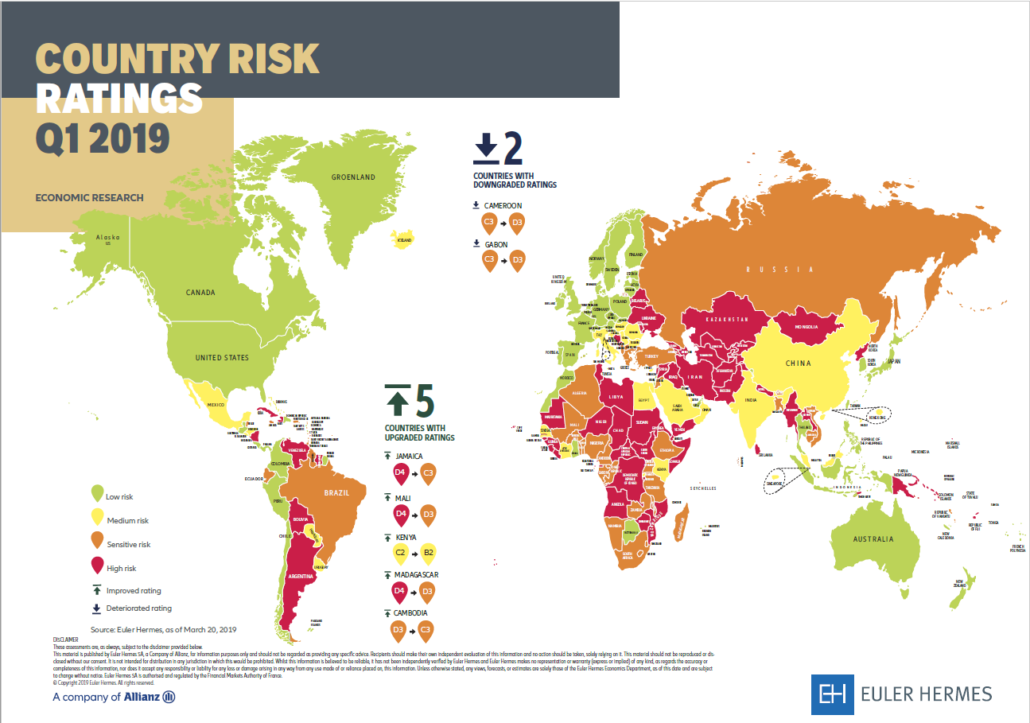

Get our Country Risk Map here

Marco Arrighini

Senior Sales Manager

Euler Hermes Switzerland | Via A. Adamini 10A | CH-6900 Lugano | Switzerland

marco.arrighini@eulerhermes.com

www.eulerhermes.ch

t +41 91 922 73 64

m +41 79 501 43 44