United Kingdom: CBAM on the way

By 2027, the United Kingdom (UK) will have implemented its own carbon border adjustment mechanism (CBAM).

On December 18, 2023, U.K. Chancellor of the Exchequer Jeremy Hunt announced in a press statement that a fee will be levied on carbon-intensive products such as iron, steel, aluminum, fertilizer, hydrogen, ceramics, glass and cement imported from Third countries. The CBAM’s design and delivery will be subject to further consultation in 2024, including an exact list of goods in scope. However, a broader reach than its European counterpart is already emerging.

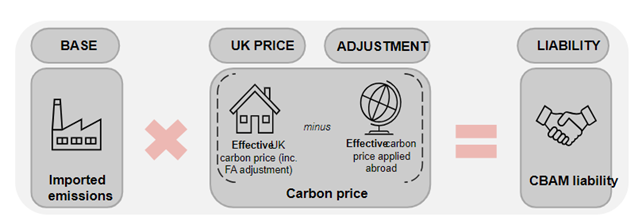

The liability applied by the CBAM will be determined by the intensity of the imported good’s greenhouse gas emissions and the gap between the carbon price applied in the country of origin (if any) and the carbon price that would have been applied had the good been produced in the UK.

The CBAM liability will fall directly on the importer of the products within scope of the UK CBAM, based on the emissions embodied in the imported goods. This system will not require the purchase or exchange of emissions certificates, but will cooperate in conjunction with the UK Emissions Trading Scheme (ETS) to ensure that imported products are priced at a carbon price comparable to that supported by British production, thus reducing the risk of carbon relocalization.

This article was originally published in Italian on www.cc-ti.ch on January 18, 2024