Financial Markets Show Resilience Amid Escalating Geopolitical Tensions

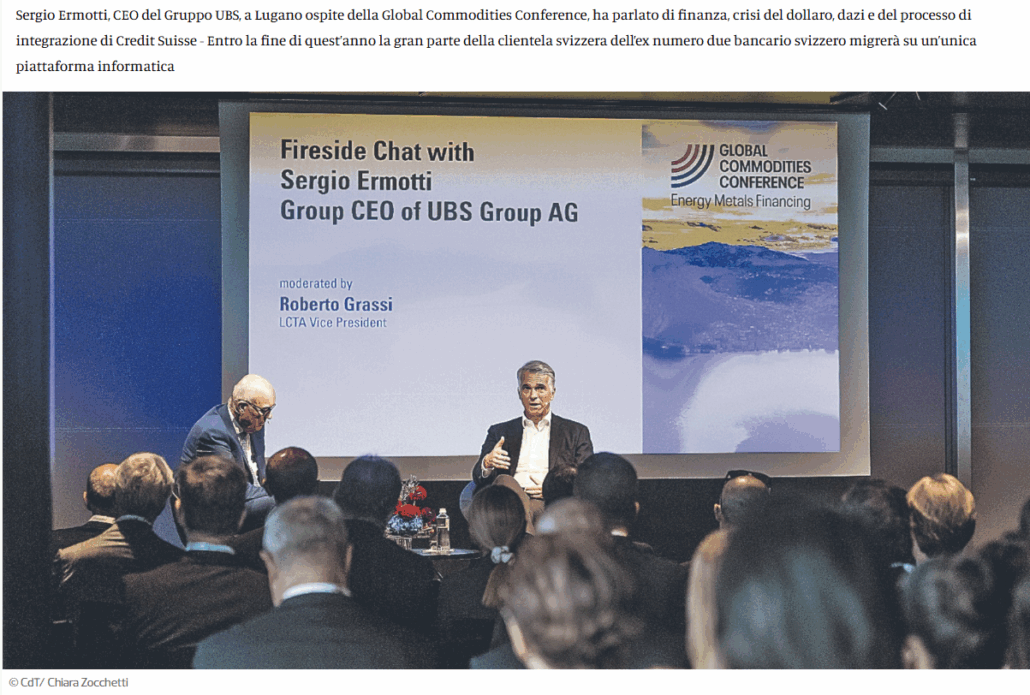

Sergio Ermotti, CEO of UBS Group, addressed key financial and geopolitical issues — including the dollar’s global role, protectionist trade measures, and the ongoing integration of Credit Suisse — during his appearance in Lugano at the Global Commodities Conference. By year-end, the bulk of Credit Suisse’s domestic client base will be transitioned onto UBS’s unified IT platform.

The two-day Global Commodities Conference concludes tomorrow. It is the flagship event of the Lugano Commodity Trading Association (LCTA) and serves as a platform to explore trends, opportunities, and challenges in the commodities market, which has been put under strain by the recent military events in the Persian Gulf.

Today, the event was opened by Sergio Ermotti, CEO of the UBS Group. In a fireside chat, the highest-ranking UBS executive did not shy away from questions posed by Roberto Grassi, vice-president of the LCTA, and a large audience. Ermotti also commented on current events such as the U.S. bombing of Iran, the international situation that could prove difficult for the global economy, and the state of integration with Credit Suisse.

On the latter topic, Ermotti pointed out that the timeline announced nearly two years ago has been adhered to and that the integration is now entering its final phase, which will involve migrating most of Credit Suisse’s former Swiss clients onto UBS’s IT platform. A complex IT process that has already begun and will be completed by the end of the year.

Resilient Markets

Last Friday, the world looked one way — today it looks another. The U.S. bombing of Iranian targets could have triggered a financial “Black Monday.” Yet that didn’t happen. According to Ermotti, the reason lies in the fact that financial markets today are much more resilient than just a few years ago. “The situation is still very complicated, but I’m surprised at how calm the markets are today,” admitted the UBS CEO.

Ermotti also addressed the alleged dollar crisis. For now, there are no viable replacements. The euro could be an alternative, but the lack of a unified capital market — i.e., the absence of common debt among EU countries — and other purely political issues within the Eurozone prevent this substitution from being immediate. Even the Japanese yen, British pound, and Swiss franc, though solid currencies, lack sufficient depth and breadth in their respective capital markets. For now, therefore, there is no real alternative to the dollar.

The discussion then turned to tariffs and the problems caused by their imposition on global trade. Ermotti expressed optimism about an agreement between the United States and Europe (including Switzerland), as well as with other trade areas (Asia and Latin America) or individual countries. We are heading toward a bilateral model in international trade, but not a return to a zero-tariff world. After all, Ermotti recalled, even under the Biden administration, the trade tariffs imposed during Donald Trump’s first term were not removed.

Future “Too Big to Fail” Rules

UBS’s position on the recent proposal by the Federal Council regarding future rules for systemically important banks (“too big to fail”) is well known. The demand for higher capital requirements raises costs (as additional capital must be remunerated) and reduces lending capacity. Even an extreme proposal — such as looser banking rules in exchange for more capitalization — would not be acceptable.

Banking, according to Ermotti, is based on trust, which is the most important form of capital. In other words, having more capital should not be seen as a justification for a riskier business model.

By Generoso Chiaradonna, Economics Editor, Corriere del Ticino

Originally published in Italian in the Corriere del Ticino on June 23, 2025 (online) and June 24, 2025 (print edition).

English translation provided by LCTA

Reproduced in full with the author’s kind permission