Coronavirus outbreak and the impact on global economy: USD26bn weekly in trade spillovers

Contribution by Euler Hermes.

The hit to China’s GDP y/y growth caused by 2019-nCoV (Coronavirus) could amount to c. 1pp, mostly over Q1 2020. A recovery should thereafter be possible, based on pent-up production and policy support.

A protracted pause in Chinese activity could be disruptive for certain supply chains such as chemicals, transport equipment, textile and electronics.

If we look into the impact on the rest of the world: manufacturing and trade recessions are likely to continue, with a trade shock of USD26bn per week from the lockdowns in China and global growth barely staying afloat at +2% in Q1 2020.

First, the coronavirus outbreak is likely to keep the manufacturing sector in recession in H1 2020. Electronics and computers are most at risk. With the business interruption in China caused by the coronavirus epidemic, — which has put several sectors at risk of supply chain disruption and lower global demand — above long-term average stocks could increase further in sectors such as textiles, machinery and transport equipment and commodities. Meanwhile, goods’ shortages are a risk in sectors with below long-term average stocks (electronics, computers). In 2019, companies’ unusually high levels of stocks pushed manufacturing production into recession, notably in the advanced economies. With the stock absorption over the past few months being only partial, the lower global demand and the higher uncertainty are likely to push inventories up in the coming months. Hence, we expect the global manufacturing sector to remain in (shallow) recession in H1 2020.

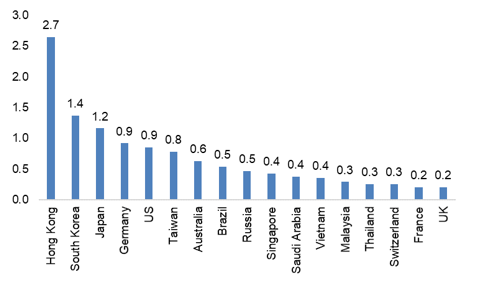

Second, potential losses of exports of goods and services to China could amount to USD26bn per week as production and trade are paused. We have revised down our global trade growth forecast for 2020 by -0.5pp to +1.3%. Hong Kong, the U.S., Japan, South Korea and Germany are most exposed. This weekly loss is more than the effect of the U.S.-China trade feud in 2019 (0.7pp). In terms of goods, the most exposed countries are Hong Kong, South Korea, Japan, Germany and the U.S. The cost could be USD18bn weekly.

Last, the macroeconomic impact should remain contained (-0.3pp on global GDP growth in Q1 2020 to +2%), if the business interruption in China doesn’t last for more than one month and business activity returns to normal after three months. While we think that the negative spillovers from the coronavirus epidemic will not last for more than three months, we doubt the global economy is strong enough to catch up entirely after the loss, given that the growth acceleration in H2 will be capped by U.S.-driven uncertainty. Overall, we think the recession in the manufacturing sector and global trade in goods will be prolonged into H1. Hence, we have revised our 2020 global GDP growth forecast by -0.1pp to +2.3%, based on a revised forecast for China (+5.6%, i.e. -0.3pp), the Eurozone (+0.9%, i.e. -0.1pp) and several other economies. We expect monetary policies to remain very active, with the ECB and the Fed even more likely to implement another rate cut in H1 2020, given that the “isolation” of China amid the coronavirus outbreak is likely to have strong negative impacts on both trade in goods and services.

Marco Arrighini

Senior Sales Manager

Euler Hermes Switzerland | Via A. Adamini 10A | CH-6900 Lugano | Switzerland

marco.arrighini@eulerhermes.com

www.eulerhermes.ch

t +41 91 922 73 64

m +41 79 501 43 44